Now that the election process is to the point where the presidential nominees of the two major parties appear clear, it’s a good time to start considering their various tax plans. Although things can change, details will have to be determined and Congress will have its say, below are some of the current proposals from the two presumptive candidates.

Individual Income Tax

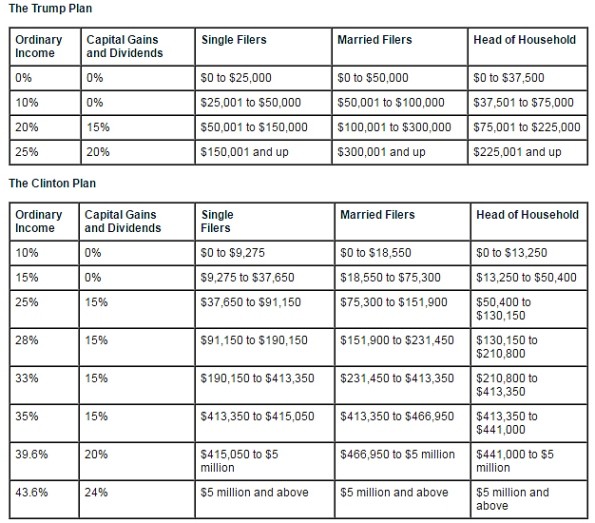

Donald Trump proposes just four brackets; Hillary Clinton proposes eight brackets.

Deductions

Clinton caps itemized deductions at 28% of the deduction. Trump phases out all deductions except for the charitable deduction and the mortgage interest deduction.

The Alternative Minimum Tax (AMT)

Clinton creates a new minimum 30% rate on individuals earning over $1 million, while Trump eliminates the AMT.

Corporate Income Tax

Trump lowers the top corporate rate to 15%; Clinton has no specific proposal at this time.

Estate Tax

Clinton increases the top estate tax rate to 45% and lowers the estate tax exclusion to $3.5 million. Trump eliminates the estate tax.

Effect of Plans on the Deficit

And as a final note, you may also want to consider how these proposals will likely impact our federal deficit. Trump’s plan is projected to increase the deficit by $9.5 trillion over the next 10 years; Clinton’s is estimated to reduce the deficit by $1.2 trillion over that same period of time.

We take great pride in helping to educate our members and customers through our many publications. The latest example is the newest edition of the

We take great pride in helping to educate our members and customers through our many publications. The latest example is the newest edition of the  Our final legislative poll question, at least for a while, asked for your biggest "victory" of the 2011 Indiana General Assembly session.

Our final legislative poll question, at least for a while, asked for your biggest "victory" of the 2011 Indiana General Assembly session.