The Indiana Chamber is championing the repeal of “the most egregious rules, regulations and executive orders that occurred in recent years.” These targets for the Trump administration were submitted to Vice President-elect Mike Pence this week, just ahead of the inauguration.

The Indiana Chamber is championing the repeal of “the most egregious rules, regulations and executive orders that occurred in recent years.” These targets for the Trump administration were submitted to Vice President-elect Mike Pence this week, just ahead of the inauguration.

The list, per Indiana Chamber President and CEO Kevin Brinegar, contains “issues we have repeatedly heard about from our member companies because they hinder their ability to prosper and provide more jobs for Hoosiers.”

These issues include increased EPA air quality standards leading to much higher energy bills with minimal environmental impact, the overtime rule that would jeopardize jobs and business growth, costly rules related to Obamacare, misguided workplace safety regulations and a fear that the FCC’s net neutrality position could stifle innovation.

“It was all too common for President Obama to circumvent Congress by issuing executive orders and to encourage federal agencies to overreach their authority and diminish economic growth,” Brinegar says.

“The Indiana Chamber is very hopeful this troubling pattern will change under President-elect Donald Trump, and we have encouraged his administration to take action to undo many of the detrimental measures enacted in this manner and to get our economy moving again.”

The 17 suggestions for repeal and their impacts are available at www.indianachamber.com/federal.

The Indiana Chamber also made the state’s congressional delegation aware of these priorities.

We’re all still recalibrating after last Tuesday’s election results. While the citizenry ponders what this means for the country and the issues dear to us, the impact on labor and employment policy is a top consideration for business-focused organizations like ours.

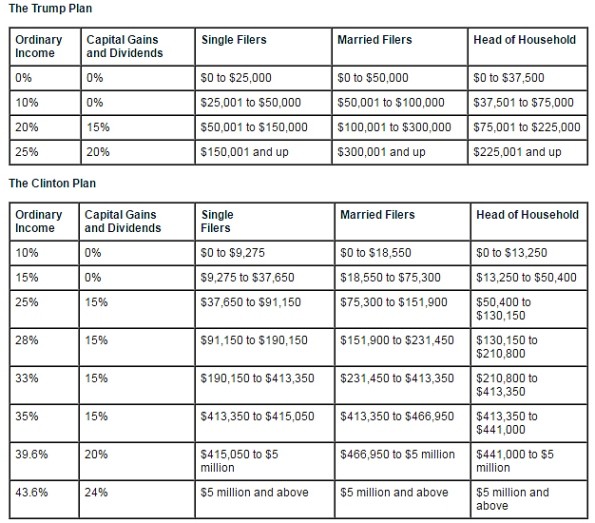

We’re all still recalibrating after last Tuesday’s election results. While the citizenry ponders what this means for the country and the issues dear to us, the impact on labor and employment policy is a top consideration for business-focused organizations like ours. Republican presidential candidate Donald Trump recently announced revisions to his tax plan. And it has already been broken down and analyzed by the Tax Foundation. Individuals would be subject to just three possible rates: 12% for up to $37,500 in income; 15% for up to $112,500; and, 33% for over $112,500 (all double for married couples.) The top capital gains rate would be 20%. It would also increase the standard deduction to $15,000 (currently at $6,300.) Carried interest would be taxed as ordinary income. And there are other changes including a new childcare cost deduction.

Republican presidential candidate Donald Trump recently announced revisions to his tax plan. And it has already been broken down and analyzed by the Tax Foundation. Individuals would be subject to just three possible rates: 12% for up to $37,500 in income; 15% for up to $112,500; and, 33% for over $112,500 (all double for married couples.) The top capital gains rate would be 20%. It would also increase the standard deduction to $15,000 (currently at $6,300.) Carried interest would be taxed as ordinary income. And there are other changes including a new childcare cost deduction.

Charlie Cook is editor and publisher of the

Charlie Cook is editor and publisher of the