More than 100 of the state’s top business leaders descended on D.C. this week for the Indiana Chamber’s Fly-in event with our congressional delegation.

More than 100 of the state’s top business leaders descended on D.C. this week for the Indiana Chamber’s Fly-in event with our congressional delegation.

Attendees received meaningful and timely information from their representatives and senators through policy briefings, special dinner discussions and office visits.

Tax reform was the hot topic. How ironic that while we were D.C.-bound that President Donald Trump would be heading to Indianapolis to roll out his tax reform plan for the first time, and taking nearly half of the Indiana delegation with him on Air Force One for the announcement. But almost all Hoosier delegation members made it back in time to address their business constituents.

The tax reform message the Indiana Chamber contingent delivered to lawmakers in D.C. was that failure should not be an option – this needs to get done!

Senator Rob Portman of Ohio wraps up his remarks on tax reform – turning the floor over to Sen. Todd Young and Sen. Joe Donnelly for a Q&A session.

What caught our attention was how deeply committed everyone is to have tax reform cross the finish line. We felt that from our guest speaker, Sen. Rob Portman of Ohio, considered the Senate fiscal expert, to Indiana members in the House and Senate, including Democratic Sen. Joe Donnelly.

They know it’s important not only to them politically but they also realize that it’s much needed policy.

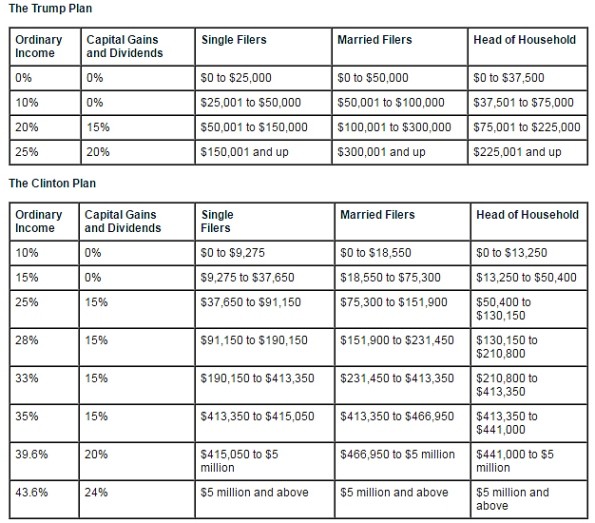

President Trump’s tax reform framework, which assuredly was done in tandem with congressional leaders, includes actions that the Indiana Chamber and business community at-large have been championing for some time:

• Lowering the corporate tax rate from 35% – the highest in the world today, which drives investment, jobs and even corporate headquarters overseas

• Lowering the top personal income tax rate – which now offers disincentives for initiative, investment and risk-taking while reducing the number of brackets

• Eliminating the alternative minimum tax (AMT), which is overly complex and ineffective, and the estate tax, which endangers many family farms and small businesses

• Adopting a territorial system in which income earned overseas is not taxed in the U.S.

In our Q&A with Sens. Donnelly and Todd Young, they were asked to handicap the likelihood – on a one to 10 scale – of a meaningful tax reform package making it through Congress. Donnelly gave it a fairly hopeful six, while Young said he’s more confident today than even a few months ago and now puts the chances for success at seven-plus.

Young added: “At a time when the rate of business creation is lower than at any period in my own life, I feel like the time is now for tax reform. And the President made a compelling case in what I thought were pretty accessible terms (for Americans).”

Donnelly summed up his thoughts on the matter: “My view on tax reform is simple: I want to try to get to ‘yes’. I think it’s much better if it’s bipartisan. … I think it’s a much better message to the country.”

At our legislative briefing, Congressman Larry Bucshon (IN-08) offered his assessment as well. “As long as both sides don’t go to our corners and stick with our traditional talking points – trying to win an election in 2018 – we are going to get this done.”

Tax reform, if done correctly, would broaden the base while lowering rates across the board – spurring new investment, job creation, economic growth and, ultimately, tax revenues, without increasing the federal deficit.

Our tax code should look like it was designed on purpose for strategic economic growth.

We are hopeful that’s what will happen in the coming months.

A big thank you to our D.C. Fly-in sponsors for making the event possible: Zimmer Biomet (dinner sponsor), Allegion (cocktail reception sponsor), Build Indiana Council (legislative briefing sponsor), AT&T, The Boeing Company, Duke Energy, The Kroger Co., Old National Bank and Wabash Valley Power.

We hope to see everyone who attended – and more – back next year!