Unique tourism campaigns are nothing new. Governing magazine recently highlighted several:

As the saying goes, if you can’t beat ’em, join ’em. That’s exactly what South Dakota did with a new tourism approach a few years ago.

After hearing from focus groups across the country that the Dakotas were nothing more than a “barren wasteland,” the state tourism agency came up with a unique campaign angle: At least we’re not Mars, an actual barren wasteland.

The voiceover in a TV ad says: “Mars. The air: not breathable. The surface: cold and barren. … South Dakota. Progressive. Productive. And abundant in oxygen. Why die on Mars when you can live in South Dakota?”

Their efforts may have paid off: The state has had a record number of tourists in the past two years.

Instagram on the Road

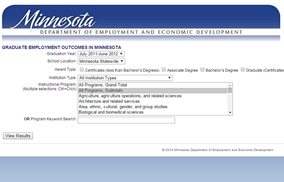

Last year, Minnesota decided to tackle the perception that the state is just a cold, snowy place by bringing its attractions to you. Really.

Explore Minnesota Tourism, the state’s tourism committee, created traveling photo booths featuring two of the state’s main attractions: the First Avenue music club, which was featured in the 1984 Prince movie Purple Rain, and scenes of the Minnesota outdoors.

The state set up the booths in cities across the country, ranging from Denver to Chicago to Kansas City, and modeled them after Instagram to encourage people to share their photos on social media.

The Prince booth came complete with a fog machine, purple lighting and a drum kit, while the other booth featured a canoe and a machine that generated morning mist and bird calls.

Come Get an Operation

San Diego doesn’t need to do much to convince people to visit: It has legendary beaches, a world-famous zoo and plenty of sunshine. Even so, the city is now betting it can convince tourists to get that elective surgery they’ve always wanted in between getting a tan or frolicking on the beach.

In 2017, city leaders launched DestinationCare San Diego, a public-private partnership to get more tourists to think of San Diego as a place to get medical care — and recover afterwards. The city hopes to compete with world-renowned medical destinations like the Mayo Clinic in Minnesota or the Cleveland Clinic in Ohio.

The city does have a strong medical sector. It’s home to the University of California health systems and Rady Children’s Hospital, which is ranked one of the best children’s hospitals in the country.

Federal highway funding is running low. Nothing new there. The Indiana Chamber, and many others, have called for long-term solutions from Washington instead of short-term fixes that simply extend the uncertainty.

Federal highway funding is running low. Nothing new there. The Indiana Chamber, and many others, have called for long-term solutions from Washington instead of short-term fixes that simply extend the uncertainty. People in powerful positions often have access to the best information.

People in powerful positions often have access to the best information. We were proud to join many Hoosiers and legislators in the 2012 session in striking down Indiana’s inheritance tax.

We were proud to join many Hoosiers and legislators in the 2012 session in striking down Indiana’s inheritance tax. My parents and grandparents are from Frankfort and I lived there until I was five, so it’s an Indiana town I have a strong affinity for. Seeing

My parents and grandparents are from Frankfort and I lived there until I was five, so it’s an Indiana town I have a strong affinity for. Seeing